Guidelines related to post-award administration of Research Fund:

NSERC Emergency Fund Guidelines

Purpose

To document the guidelines for the use of Natural Sciences and Engineering Research Council (NSERC) General Research Fund (GRF) to ensure compliance with the Agency’s financial administration guide and UBC’s related policies. The NSERC GRF will be renamed NSERC Emergency Fund to be in line with the nature of the funding.

Guidelines

The NSERC Emergency Fund Committee is composed of five members, including the UBC NSERC Advisor as the Chair.

The NSERC Emergency Fund Committee’s mandate is to approve requests for funding for purposes such as emergency equipment repair or bridge funding between grant applications. Requests to fund students are generally not considered for funding.

PI sends request to the UBC NSERC Advisor

The Advisor circulates the request to the Committee

The Committee reviews and makes decision on the request

The term is generally for one year to meet NSERC spending requirement. If needed, a request for extension should be made before the end of the term

The Office of Research Services (ORS) is notified and creates a new grant

Research Finance (RF) automatically sweeps any remaining fund at end of the grant to the master account

For every request for funding, matching fund is required from the department/faculty, unless there is a clear justification on why that is not possible.

The NSERC Advisor and in consultation with the Managing Director, Research Support Services (RSS), reviews and approves internal extensions to use NSERC approved residual balances. If approved, the residual balance remains in the grant with new end date.

Residual balance is determined at the end of the grant with the Form 300 submitted to Tri-Agency’s portal. NSERC normally provides formal approval of the residual balance to be transferred to the master account one year after Form 300 submission.

RF provides semi-annual report to the NSERC Emergency Fund Committee on funding status and availability of funds.

For questions, contact the UBC NSERC Advisor

Reference:

Guidelines for the General Research Fund (NSERC and SSHRC)

Hospital Authorities Reimbursement

Hospital authorities through the various hospitals incur expenses for UBC PIs who hold research grants at UBC.

UBC is ultimately responsible to the sponsor that is funding the research project. Providing appropriate and complete supporting documentation is one of the elements for compliance and an important control to eliminate risks associated with insufficient or improper supporting documentation. We therefore need to clarify the supporting documentation requirements according to type of transaction.

The PI’s approval on the "Create Supplier Invoice or Create Supplier Invoice Request" task in Workday represents authorization to pay.

Required Supporting Documentation

Salary and Benefits

- Employee name

- Position/Job title

- Nature of work performed

- Period worked

- Proof of payment, as posted in general ledger (GL)

- Formula/calculation how salary or benefit charged based on proof of payment

- Formula/calculation of allocation with no proof of payment, i.e. vacation leave

Operational/Technical/Laboratory Supplies

- If taken from hospital inventory:

- Item (description)

- Quantity

- Unit cost

- Total

- If reimbursement is third-party vendor payment:

- Copy of invoice/receipt (original may be requested during audit)

- Purchase order according to UBC guidelines

Travel Expenses

- Travel expense report with the following information:

- Name of traveler

- Position/Job Title

- Inclusive dates of travel and location

- Purpose of travel that explains its relevance to the research project

- Signature of traveler

- Provide backup(s) that the travel took place, such as

- Boarding pass (only if required by the sponsor)

- E-ticket receipt

- Conference registration/prospectus/agenda

- Hotel receipt

- Transportation receipt, i.e. taxi, bus fare

Fees – Professional/Technical/Research Services

- Internal billing

- Description of service or work done as it relates to the research project

- Period covered

- Formula or calculation of fees

- If reimbursement involves a third-party vendor payment

- Agreement or purchase order according to UBC guidelines

- Copy of invoice/receipt (original may be requested during audit)

Alternative

To simplify the process involving third-party payment and travel reimbursement and for original supporting documentation to be maintained at UBC, we strongly recommend that UBC directly reimburses the vendor or traveller.

Interfund Transfer - Research Grant

Interfund transfers are initiated by Office of Research Services (ORS) and Innovation UBC for the current month through integration from RISe to Workday (WD), and Research Finance (RF) will process succeeding fund transfers.

ORS and Innovation UBC will provide a report of succeeding interfund transfers for RF to process in Workday.

Departments should coordinate with ORS or Innovation UBC for interfund transfers affecting Grant worktags, to update the budget in RISe then to Workday.

Interfund transfer is only applicable for Fixed Amount award line type. There should be no interfund transfer for Cost Reimbursable award line type in order not to duplicate revenue of the non-primary award line. Revenue for Cost reimbursable award line is recognized at the specific award line where expense is posted.

Ledger Accounts & Spend/Revenue Categories:

| Ledger Account | Spend Category |

|---|---|

| 9800 Transfers Out | Transfers Out | From Capital |

| Transfers Out | From Endowment | |

| Transfers Out | From General Purpose Operating | |

| Transfers Out | From Research | |

| Transfers Out | From Scholarships and Bursaries | |

| Transfers Out | From Trust |

| Ledger Account | Revenue Category |

|---|---|

| 4800 Transfers In | Transfers In | From Capital |

| Transfers In | From Endowment | |

| Transfers In | From General Purpose Operating | |

| Transfers In | From Research | |

| Transfers In | From Scholarships and Bursaries | |

| Transfers In | From Trust |

Unrestricted Research Funds

Guidelines

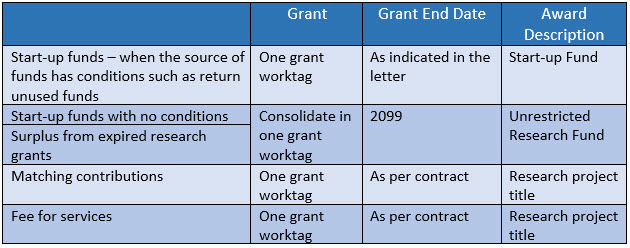

Research funds from internal sources or from external sources where the Sponsor has no restrictions on the use of funds are recorded in Unrestricted Research Fund Code FD220. Internal sources include funds transferred from programs, unrestricted research, and unrestricted gifts worktags in fund code FD810. There are four major components of unrestricted research funds:

- Start-up funds

- Surplus from expired research grants

- Matching contributions

- Fee for Services

- Start-up funds are funds from internal sources, generally from programs and unrestricted research worktags to support Principal Investigators (PIs) establish their research operations.

- Surplus from expired research grants must meet the following criteria to be categorized as unrestricted:

- Agreement or award letter indicates that surplus will be retained by the PI/Institution, or

- Agreement or award letter is silent on the treatment of surplus and it is below 40% of total project funding, or

Sponsor is invoiced through cost recovery or upon delivery of certain milestones.

These funds were originally intended for research and should continue to be used for such purpose in a broad sense, such as travel expenses to attend research conferences, hire students for research and other research supplies when these are not covered by other research projects.

PI must comply with applicable ethics requirements when funds are used for research projects.

- Matching contributions are from internal sources, such as programs, unrestricted research and unrestricted gifts worktags to comply with certain conditions for the research project as whole.

- Fee for services are revenues generated for activities with research component, including clinical trials.

A research grant worktag is created to facilitate accounting and reporting where needed with differentiating parameters as follows:

Create Research Grant Worktag

- ORS/Innovation UBC Research Officer creates research grant worktag following standard guidelines in creating an award/grant in RISe.

Process for Expired Grants with Surplus

Research Finance Officer -

- Reviews expired research grant with surplus

- Apply the criteria above to determine if surplus could be categorized as unrestricted and be retained by PI/institution

- If so, coordinates with PI to confirm the transfer of surplus to his/her unrestricted research grant, if one already exists. If not, PI has to request the setup of new unrestricted research by submitting an RPIF to ORS

- Transfers the surplus net of overhead (if expired grant F&A Rate Agreement > 0%) to PI’s unrestricted research grant

- Inactivates the expired grant

- Requests ORS/Innovation UBC to increase the budget of PI’s unrestricted grant.

Applicable UBC policies and guidelines

- LR2 Research Policy

- FM4 Research Over-expenditure Policy

- FM8 Business Expenses Rules and related documents